Introduction

The medical technology (MedTech) sector is undergoing a remarkable transformation. Once a niche corner of healthcare focused on devices like pacemakers and surgical instruments, MedTech has expanded into a dynamic field that blends biotechnology, artificial intelligence (AI), robotics, and data-driven care. This evolution has also made MedTech one of the most exciting spaces for initial public offerings (IPOs), with investors eager to back companies that promise both groundbreaking healthcare solutions and long-term market growth.

Definition

MedTech IPO Innovations refers to groundbreaking advancements, strategies, and trends in the medical technology sector that drive companies to go public through Initial Public Offerings (IPOs). It encompasses the development of novel medical devices, digital health platforms, diagnostics, and biotech tools that not only improve patient outcomes but also attract investor interest by showcasing strong market potential, regulatory readiness, and scalable business models.

The MedTech IPO Boom

Over the past decade, MedTech companies have gained traction on global stock exchanges. In the early 2000s, biotechnology firms dominated healthcare IPO headlines. But in recent years, medical technology companies – from surgical robotics pioneers to digital health platforms – have carved out a significant share of IPO activity.

Several factors explain this boom:

Demographic Shifts:

An aging global population is creating unprecedented demand for advanced medical solutions. Chronic diseases such as diabetes, cardiovascular disorders, and neurodegenerative conditions require innovative monitoring, diagnostic, and therapeutic tools.

Pandemic Acceleration:

The COVID-19 crisis accelerated adoption of telehealth, remote monitoring, and diagnostic tools. Investors realized MedTech was not only essential for resilience but also for the future of healthcare delivery.

Technological Convergence:

Advances in artificial intelligence, data analytics, wearable sensors, and robotics have created a new generation of MedTech products that go far beyond traditional devices.

Investor Appetite:

With biotech drug development often requiring years of trials and regulatory hurdles, investors see MedTech as offering faster commercialization timelines and scalable business models.

These dynamics have made MedTech IPOs attractive both on Wall Street and global exchanges such as London, Hong Kong, and Singapore.

Types of MedTech Companies Going Public

MedTech is a diverse industry. IPO candidates come from several sub-sectors, each bringing its own innovations to market:

- Robotics and Minimally Invasive Surgery

Companies like Intuitive Surgical paved the way, and today new entrants are applying robotics to orthopedics, neurology, and cardiovascular procedures. Their IPOs often draw strong attention due to the transformative potential of robotic precision. - Digital Health Platforms

From telemedicine providers to AI-based diagnostic platforms, digital health startups are capturing investor interest by leveraging software-driven scalability. These IPOs often highlight recurring revenue models that appeal to growth investors. - Wearables and Remote Monitoring

Devices that track heart rhythms, glucose levels, or oxygen saturation are no longer niche consumer gadgets—they are becoming FDA-approved medical devices. IPOs in this space often attract both healthcare and technology investors. - Diagnostics and Imaging

Breakthroughs in molecular diagnostics, portable imaging devices, and AI-assisted scans are helping clinicians detect diseases earlier and more accurately. IPOs in this segment tend to emphasize clinical validation and reimbursement pathways. - Next-Gen Therapeutic Devices

Innovations such as brain-computer interfaces, 3D-printed implants, and bioelectronic medicine are pushing MedTech into futuristic territory. While early-stage, some of these firms are exploring IPOs to fund scaling and regulatory approvals.

Case Studies: Notable MedTech IPOs

Shockwave Medical (NASDAQ: SWAV):

This California-based company went public in 2019 with its intravascular lithotripsy technology for treating calcified cardiovascular disease. Its IPO raised over $97 million, and since then, the stock has significantly outperformed expectations, showcasing investor enthusiasm for differentiated medical devices.

ProSomnus (NASDAQ: OSA):

Specializing in precision oral appliances for obstructive sleep apnea, ProSomnus took the SPAC route in 2022. Its debut highlighted how MedTech firms addressing widespread yet undertreated conditions can leverage IPOs to fuel awareness and market penetration.

iRhythm Technologies (NASDAQ: IRTC):

Known for its wearable heart monitoring device, iRhythm had its IPO in 2016 and became a prime example of how digital health and MedTech can converge successfully.

These examples demonstrate that MedTech IPOs often reward investors who can identify scalable innovations in high-need medical areas.

Challenges Facing MedTech IPOs

Despite strong market interest, MedTech IPOs face hurdles that companies and investors must navigate:

- Regulatory Complexity

Unlike software startups, MedTech firms must secure approvals from regulatory bodies like the FDA or EMA. The timeline, cost, and uncertainty of this process can affect IPO timing and valuations. - Reimbursement Landscape

Even with regulatory approval, a device’s commercial success often hinges on insurance reimbursement. Investors pay close attention to whether payers recognize the value of new technologies. - Capital Intensity

Developing, manufacturing, and scaling medical devices often require significant upfront capital. IPO proceeds are crucial, but companies must show a clear path to profitability. - Market Competition

Large incumbents such as Medtronic, Johnson & Johnson, and Abbott can dominate markets, making it difficult for new entrants to carve out share without unique differentiation. - Post-IPO Performance

Some MedTech IPOs have struggled after going public, as expectations for rapid adoption clash with the slower pace of healthcare system integration.

Investor Perspectives

From an investment standpoint, MedTech IPOs offer both opportunity and risk. On one hand, the sector aligns with long-term trends: aging populations, demand for cost-effective healthcare, and the blending of technology with medicine. On the other, valuation bubbles can form, especially around highly hyped technologies.

Savvy investors often evaluate MedTech IPOs through several lenses:

- Clinical Efficacy: Does the product demonstrate meaningful health outcomes?

- Market Size: Is the addressable patient population large enough to justify growth projections?

- Competitive Edge: Does the company have patents, data, or partnerships that create defensibility?

- Scalability: How easily can the product be manufactured, distributed, and adopted by healthcare systems?

- Financial Discipline: Is the company balancing innovation with sustainable business practices?

The Future of MedTech IPO Innovations

Looking ahead, several trends are likely to shape MedTech IPO activity:

- AI-Powered Devices

From diagnostics to personalized treatment plans, AI-driven MedTech solutions will attract both technology and healthcare investors. - Decentralized Healthcare

Devices enabling care outside hospitals – whether at home or in community settings – will continue to gain traction. IPOs in this space will emphasize patient empowerment and cost reduction. - Sustainability and Accessibility

MedTech firms that design affordable, eco-friendly devices for emerging markets may expand IPO interest beyond traditional geographies. - Global Listings

More MedTech companies may choose to list outside the U.S., leveraging regional exchanges to attract local investors. - Partnership Ecosystems

Expect IPO candidates to showcase partnerships with hospitals, insurers, and tech giants to prove their integration into the healthcare value chain.

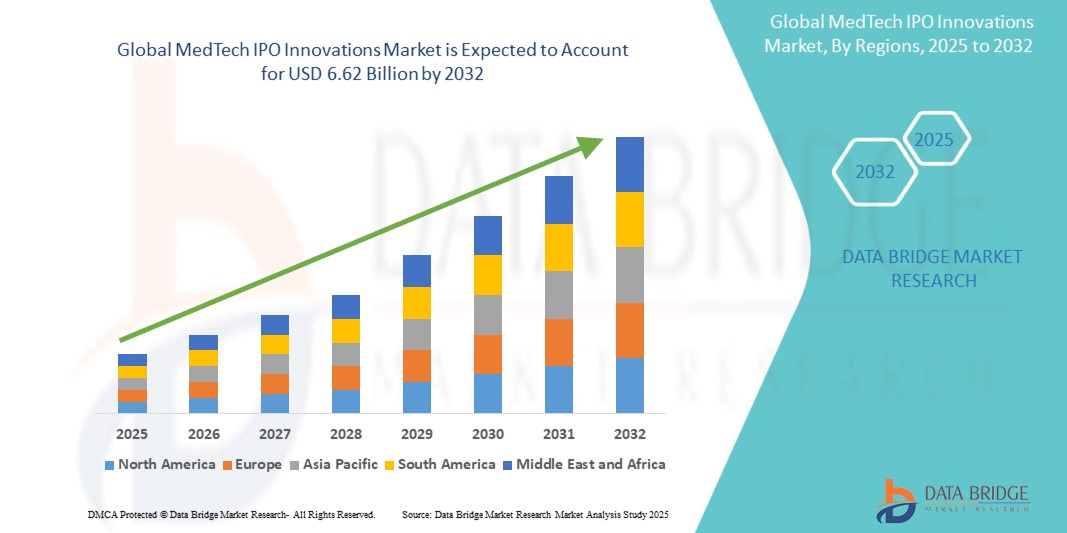

Growth Rate of MedTech IPO Innovations Market

According to Data Bridge Market Research, the size of the global medtech IPO innovations market was estimated at USD 1.98 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 16.30% to reach USD 6.62 billion by 2032.

Learn More: https://www.databridgemarketresearch.com/reports/global-medtech-ipo-innovations-market

Conclusion

MedTech IPO innovations are reshaping the intersection of healthcare and capital markets. These companies are not only raising funds but also bringing life-changing technologies into mainstream healthcare. For investors, the sector offers a mix of risk and reward, requiring careful due diligence and an understanding of healthcare dynamics. For patients, the surge in MedTech IPOs means faster access to innovations that can improve quality of life, extend longevity, and reduce the burden of disease.