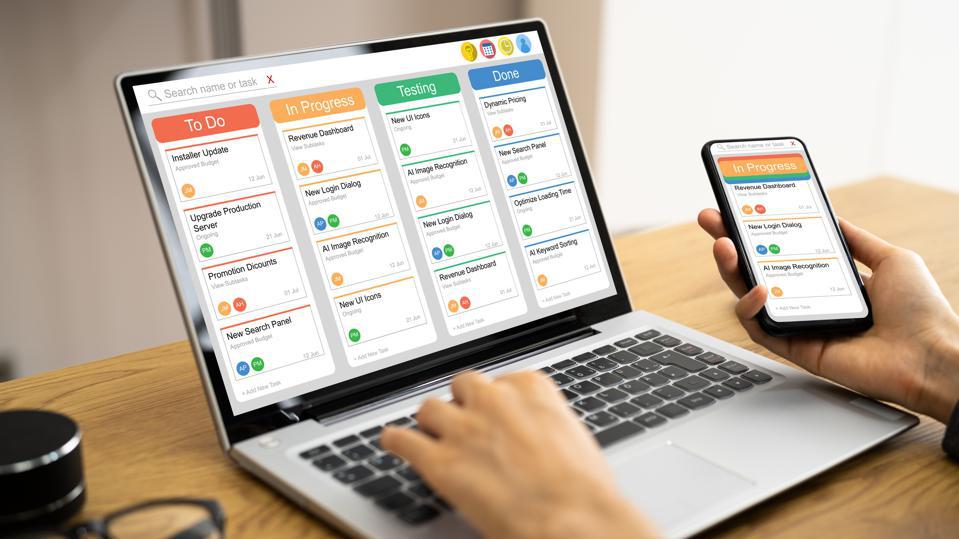

A compliance management dashboard is more than just a visual tool; it is the central framework for organizations to monitor, assess, and respond to compliance requirements as they evolve. Real-time tracking of critical metrics helps decision-makers ensure regulatory obligations are met, risks are reduced, and audit readiness is maintained without unnecessary delays. Choosing the right metrics to monitor can define whether a business simply reacts to challenges or proactively manages them.

is more than just a visual tool; it is the central framework for organizations to monitor, assess, and respond to compliance requirements as they evolve. Real-time tracking of critical metrics helps decision-makers ensure regulatory obligations are met, risks are reduced, and audit readiness is maintained without unnecessary delays. Choosing the right metrics to monitor can define whether a business simply reacts to challenges or proactively manages them.

Why Real-Time Metrics Matter

Regulatory environments are becoming increasingly complex, especially in sectors where strict oversight is constant. Real-time insights offer two clear advantages: immediate visibility into compliance gaps and the ability to respond before these gaps escalate into risks. This ensures consistent alignment with laws, standards, and internal controls, while supporting trust among stakeholders.

Key Metrics Every Dashboard Should Include

1. Regulatory Adherence Status

A real-time overview of adherence to various industry standards, including sector-specific frameworks, should always sit at the core of the dashboard. It allows organizations to instantly know whether they are compliant with current mandates or if corrective action is required.

2. Policy Violation Alerts

Every compliance management process depends on the timely detection of policy violations. Dashboards should track incidents such as unauthorized access, missing documentation, or unapproved processes. Immediate alerts enable teams to remediate before violations turn into fines or penalties.

3. Risk Exposure Levels

Risk visibility is fundamental. By measuring exposure levels across departments, vendors, and business units, organizations gain clarity on which areas demand urgent attention. A granular breakdown of risks helps prioritize resources effectively and reduces the chance of oversight.

4. Audit Readiness Score

Compliance is not only about staying within regulatory boundaries but also about being prepared for periodic audits. A dashboard metric that measures readiness in real time ensures supporting evidence, records, and documentation are always available when needed.

5. Incident Response Timelines

Tracking how quickly compliance-related incidents are detected, reported, and resolved provides valuable insight into organizational efficiency. Shorter timelines demonstrate strong governance while longer delays highlight weak points that may need process or policy refinement.

6. Training and Awareness Completion

Employee awareness is often overlooked, yet it is critical for compliance. Dashboards should include completion rates for mandatory training modules, certifications, and awareness programs. This not only strengthens compliance but also improves cybersecurity for financial services, where employee knowledge can significantly lower risks.

7. Data Access and Control Metrics

Real-time monitoring of who is accessing sensitive data, how often, and under what circumstances is vital. For industries like finance, healthcare, and critical infrastructure, these metrics directly tie into compliance obligations and security outcomes.

8. Vendor and Third-Party Compliance

Organizations are rarely fully independent; they rely on vendors and third parties. A strong compliance dashboard must capture the compliance posture of these partners. This ensures that external risks do not compromise internal compliance efforts.

Strengthening Compliance Through Sector-Specific Monitoring

The Case of Financial Services

The financial sector faces heightened regulatory scrutiny, where cybersecurity for financial services is not simply recommended but mandated. Dashboards that track fraud attempts, customer data security, and adherence to frameworks like PCI DSS help institutions remain vigilant while aligning with strict requirements. Real-time visibility ensures financial institutions reduce vulnerabilities and remain confident during audits.

The Role of Technology and Automation

Modern dashboards rely on automation and integrations with existing systems. Automated feeds from monitoring tools, HR systems, and risk platforms provide data that is updated without manual intervention. This not only saves time but also ensures accuracy, which is crucial in high-stakes industries like finance and healthcare.

Balancing Compliance and Operational Agility

While compliance may appear rigid, dashboards can make processes agile by providing live updates instead of static reports. This balance helps leadership teams make decisions without delay, ensuring operations are not slowed down by manual reporting cycles.

Conclusion

A well-structured compliance management dashboard equips organizations with real-time visibility, reduces risks, and ensures audit readiness. From regulatory adherence and policy violations to vendor oversight and employee training, each metric plays a role in creating a culture of accountability. For highly regulated industries, including those focusing on cybersecurity for financial services, dashboards provide the much-needed clarity to stay secure and compliant.

Panacea Infosec enables organizations to strengthen their compliance posture with advanced solutions tailored to evolving risks, while also supporting critical needs such as wireless penetration testing.