Introduction

The forex market is one of the most dynamic financial arenas, attracting traders from across the globe who aim to profit from currency fluctuations. With thousands of brokers competing for attention, choosing the right platform is often challenging. In this Tradit Review, we take a closer look at Tradit, analyzing its trading features, account options, regulatory standing, platforms, and overall credibility. The goal is to provide traders with a clear picture of whether this broker aligns with their financial goals.

What Is Tradit?

Tradit positions itself as a forex and CFD broker, offering clients access to a range of trading instruments, including currency pairs, indices, commodities, and cryptocurrencies. In recent years, many new brokers have entered the market, and each claims to provide transparency, tight spreads, and advanced trading tools. However, traders must go beyond the surface to assess whether those promises hold true. This Tradit Review aims to address the critical factors that matter most—safety, costs, and performance.

Account Types and Trading Conditions

Like most brokers, Tradit provides multiple account types designed to suit beginners and experienced traders. Account tiers often vary in minimum deposit requirements, spreads, commissions, and leverage.

- Spreads and Commissions: The broker claims to offer competitive spreads, but actual trading costs can vary depending on the instrument and account type. For active traders, spreads play a crucial role in profitability.

- Leverage: High leverage may appeal to risk-takers, but it also increases exposure to significant losses. Regulators worldwide have warned about the dangers of excessive leverage, so traders should evaluate carefully before using it.

- Deposits and Withdrawals: Accessibility of funds is one of the most important factors in choosing a broker. In this Tradit Review, it is worth noting whether withdrawal requests are processed smoothly and whether the broker charges hidden fees.

Trading Platforms and Tools

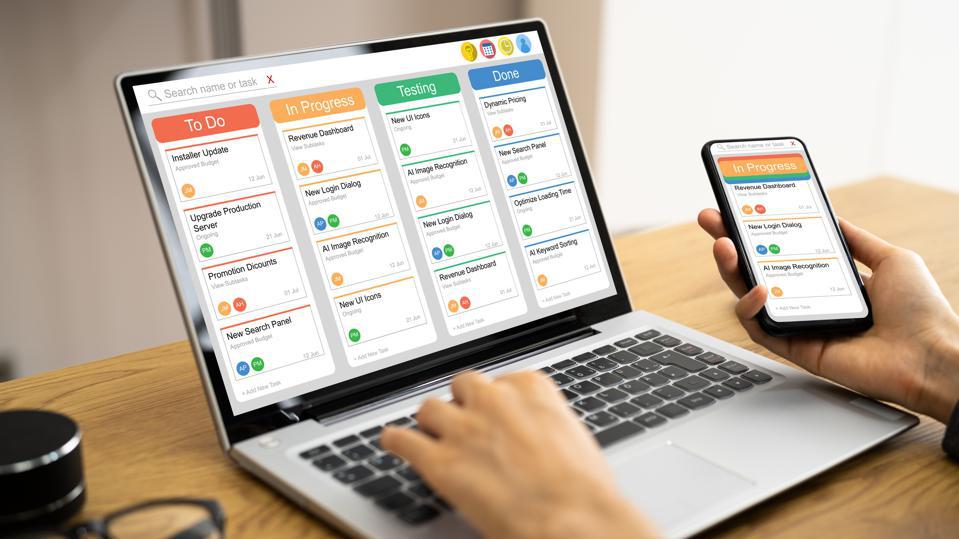

A broker’s trading platform is where financial strategies are executed. Tradit promotes itself as offering user-friendly platforms with charting capabilities, order management, and technical indicators. Most reputable brokers use platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), trusted for their reliability. If Tradit uses proprietary technology, traders must check whether it is stable, fast, and intuitive.

Other factors to consider include:

- Mobile trading apps for those who need flexibility.

- Research tools and market analysis, which help traders make informed decisions.

- Copy trading or social trading options, popular among new traders.

Regulatory Status and Safety of Funds

One of the most significant parts of this Tradit Review is the question of regulation. Financial markets are filled with unregulated brokers that expose clients to unnecessary risks. Traders should always confirm whether Tradit operates under the oversight of a respected regulator such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Regulated brokers must comply with strict requirements, including segregated client funds, transparent reporting, and fair execution of trades. If Tradit lacks strong regulation, this could be a red flag for potential investors.

Customer Support and Service Quality

A broker’s credibility is also reflected in its customer service. During this Tradit Review, the quality of Tradit’s support is a key point of analysis. Reliable brokers offer multiple communication channels, including live chat, email, and phone support. More importantly, support should be available 24/5 to match global forex market hours.

Traders frequently face urgent questions about account access, platform errors, or financial transactions. Slow or unhelpful responses can harm a trader’s ability to operate effectively in the market.

Education and Resources

Forex trading is complex, and not all traders begin with the same level of knowledge. The presence of quality educational resources is another factor to evaluate in this Tradit Review. Many brokers provide free tutorials, webinars, market outlooks, and eBooks to help traders sharpen their skills.

Strong educational support demonstrates that a broker is committed to client success rather than simply encouraging deposits. For beginners, this could make a significant difference in long-term outcomes.

Pros of Trading with Tradit

Based on common broker features, some possible advantages include:

- Access to multiple trading instruments.

- User-friendly platform suitable for different levels of experience.

- Flexible account types to match varying capital levels.

- Tools for technical analysis and risk management.

Potential Concerns About Tradit

However, this Tradit Review would not be complete without highlighting potential drawbacks. These concerns may include:

- Lack of clear regulatory information, raising questions about client fund security.

- Limited transparency on spreads and commissions.

- Mixed user feedback regarding withdrawals or account handling.

- Fewer advanced features compared to top-tier brokers in the industry.

Comparisons with Other Forex Brokers

When considering Tradit, traders should also compare it with more established brokers. Leading platforms regulated by top authorities often provide stronger investor protection, clearer fee structures, and more advanced trading tools. In finance, transparency is key, and traders must ensure they are working with a trustworthy partner.

Risk Management in Forex Trading

Regardless of which broker a trader chooses, the importance of risk management cannot be overstated. Forex trading involves significant risk due to leverage and market volatility. Traders must adopt strategies such as:

- Setting stop-loss and take-profit levels.

- Diversifying trading instruments.

- Avoiding overexposure to a single trade.

This Tradit Review reminds readers that no broker can eliminate trading risks, but a reliable platform can help minimize unnecessary financial uncertainty.

Final Verdict on Tradit Review

After analyzing Tradit’s services, it is clear that while the broker provides access to forex and CFD trading, there are areas that require careful attention. Traders should investigate regulatory details, test withdrawal processes, and evaluate platform stability before committing significant capital.

In summary:

- Tradit offers multiple account options and trading tools.

- Regulatory status remains one of the most critical concerns.

- Customer support and educational resources may vary in quality.

- Traders should weigh both the pros and cons before deciding.

For those serious about forex trading, this Tradit Review suggests conducting thorough due diligence, comparing Tradit with other brokers, and starting with a small investment to test the broker’s services.

Conclusion

The forex market continues to grow, offering opportunities for traders worldwide. However, selecting the right broker is one of the most important financial decisions a trader will make. This Tradit Review highlights both strengths and weaknesses, encouraging readers to approach with caution and conduct independent research. In the world of forex, knowledge, discipline, and broker reliability form the foundation of long-term success.